CA SAR 7 2014 free printable template

Get, Create, Make and Sign sar 7 form

How to edit sar 7 form online

CA SAR 7 Form Versions

How to fill out sar 7 form

How to fill out CA SAR 7

Who needs CA SAR 7?

Instructions and Help about sar 7 form

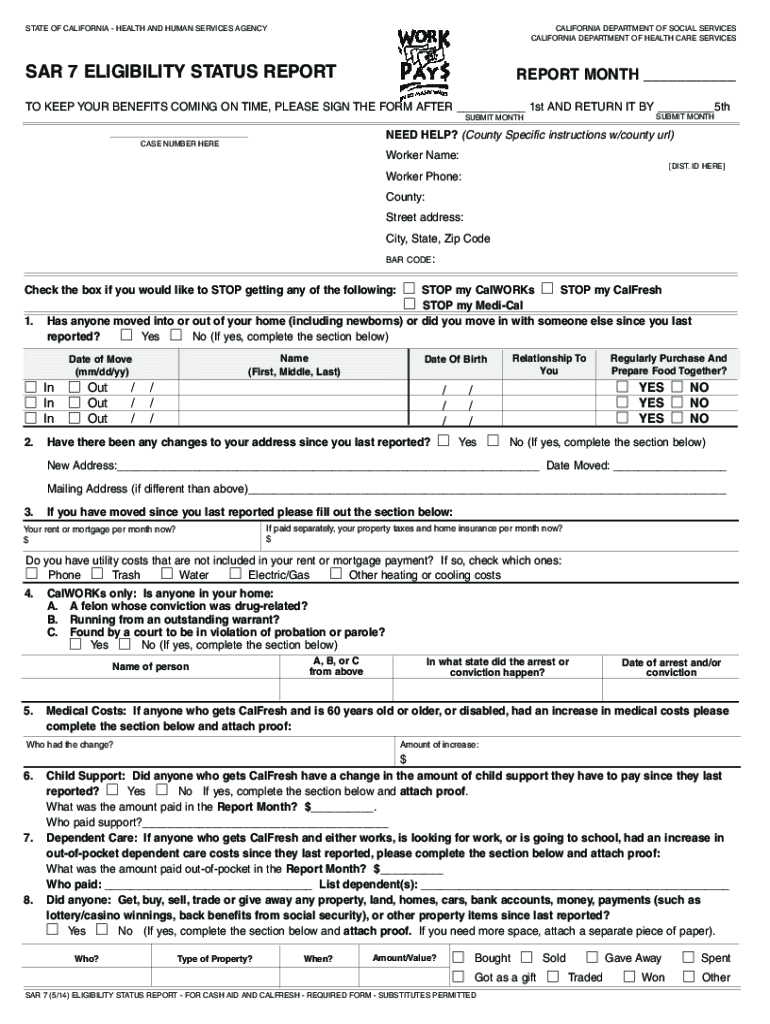

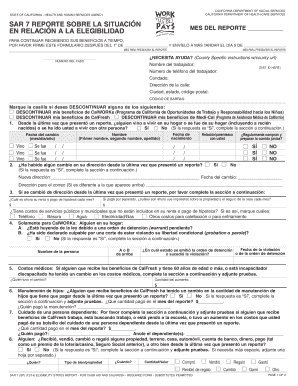

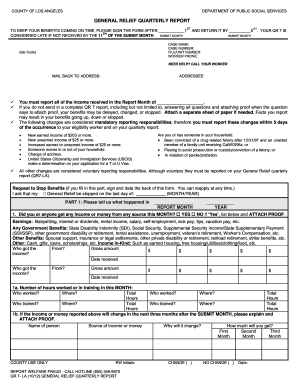

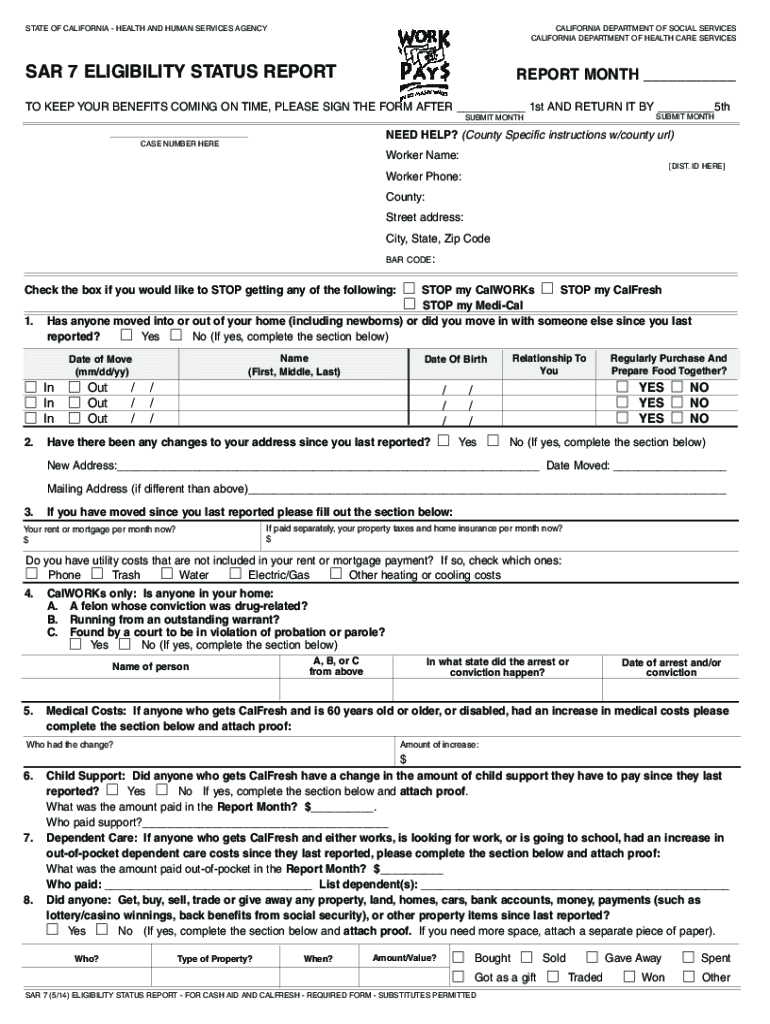

Welcome to the County of San Diego SAR seven video my name is Nancy circuit Mondrian, and I'll be talking about semiannual reports one for eligibility status reports the SAR seven form or eligibility status report is used to determine ongoing benefits for Gasworks and Callers recipients sign and submit the SAR seven timely with attached require verifications and the county will use this information to determine ongoing benefit amount and eligibility reports the county what has changed is your last report this includes household composition changes in address or shelter cost medical costs' child support paid and dependent care cost if you're receiving Afresh changes in employment or hours work or any changes in property of resources you must also report all earnings and our money received in the report month of those of you that are buying and preparing food with you or any relatives if you are receiving Gasworks cash assistance you can also report anticipated income changes for example if you are stopping or starting a new job you may notice in your SAR seven that you have a specific month for which you are required to report information regarding your family this is called the report month this cycle is based on the application or when you first start receiving assistance for example if you first started receiving assistance in January the SAR seven will ask for information for the month of May this is your report month you will have to return the form in June this is to submit month the next payment cycle will start in July the county will mail you the SAR seven by the end of the report month you must include verifications and our information that happened to your family in the report month the SAR seven is due by the fifth of the submit month contact the county we have not received with our seven by the beginning of the submit month if the report is received incomplete or laid your benefits might be the later stop please be aware that the county will have to collect any overpayment or overage wins if the information you reported in this our seventh cause your benefits to decrease for the next payment cycle you can submit this our seven online and upload verifications if you have my benefits Kelvin account please visit my benefits kelvins that ole KG you can also visit get kelp fresh that orgy Sr seven make sure you log in during the submit money or by mail by using the return envelope provided you can also submit in person at the drop box and our Family Resource Center's you may also request a replacement of the SAR seven by calling access self-service at one eight six two six two nine eight one how can I help you thank you for watching

What is california form sar 7?

People Also Ask about

What is an SAR 7 form?

How long does it take to process SAR 7?

What is SAR 7?

Can I do SAR 7 over the phone?

What happens if you don't fill out SAR 7 form?

Can I print out a SAR 7 online?

What does SAR 7 ask for?

What do I report in SAR 7?

Do I have to fill out SAR 7?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sar 7 form?

How to fill out sar 7 form?

What information must be reported on sar 7 form?

How do I edit sar 7 form online?

Can I sign the sar 7 form electronically in Chrome?

How do I edit sar 7 form on an iOS device?

What is CA SAR 7?

Who is required to file CA SAR 7?

How to fill out CA SAR 7?

What is the purpose of CA SAR 7?

What information must be reported on CA SAR 7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.